In an ever-changing stock market landscape, investors are constantly looking for strategies that will allow them to maximize returns. Among the myriad of investment approaches, value investing has stood the test of time, appealing to those who prefer a more conservative, research-based path to wealth accumulation. Often considered the underdogs of the stock market, value stocks offer a compelling proposition for investors willing to look beyond the hype.

Value stocks are shares of companies that appear undervalued based on fundamental analysis. These companies typically have strong fundamentals, such as stable earnings, high dividends, and solid cash flow, but their stock prices are lower than their financial strength would suggest. The discrepancy between the market price and intrinsic value is an opportunity for value investors.

Characteristics of Value Stocks

Companies classified as value stocks typically have solid balance sheets with manageable debt levels and significant assets. Because value stocks are already trading at lower prices, they may have less room to fall, potentially providing a margin of safety for investors. The higher dividend yields of many stocks can provide a reliable income stream, making them particularly attractive to income-oriented investors.

Who Value Stocks Might Suit

Long-Term Investors

Value investing requires patience and a long-term perspective. Investors willing to hold their investments for several years to give the market time to realize and correct the undervaluation are ideal candidates for value stocks.

Risk-Averse Investors

Value stocks are typically less volatile than growth stocks, making them suitable for risk-averse investors. These investors prioritize capital preservation and seek stable income rather than chasing risky, high-return opportunities.

Diversification Seekers

Investors looking to diversify their portfolio across a variety of investment strategies may want to consider adding value stocks to their portfolio to balance their holdings. Adding value stocks can reduce overall portfolio risk and increase portfolio stability, especially during market downturns when growth stocks may falter.

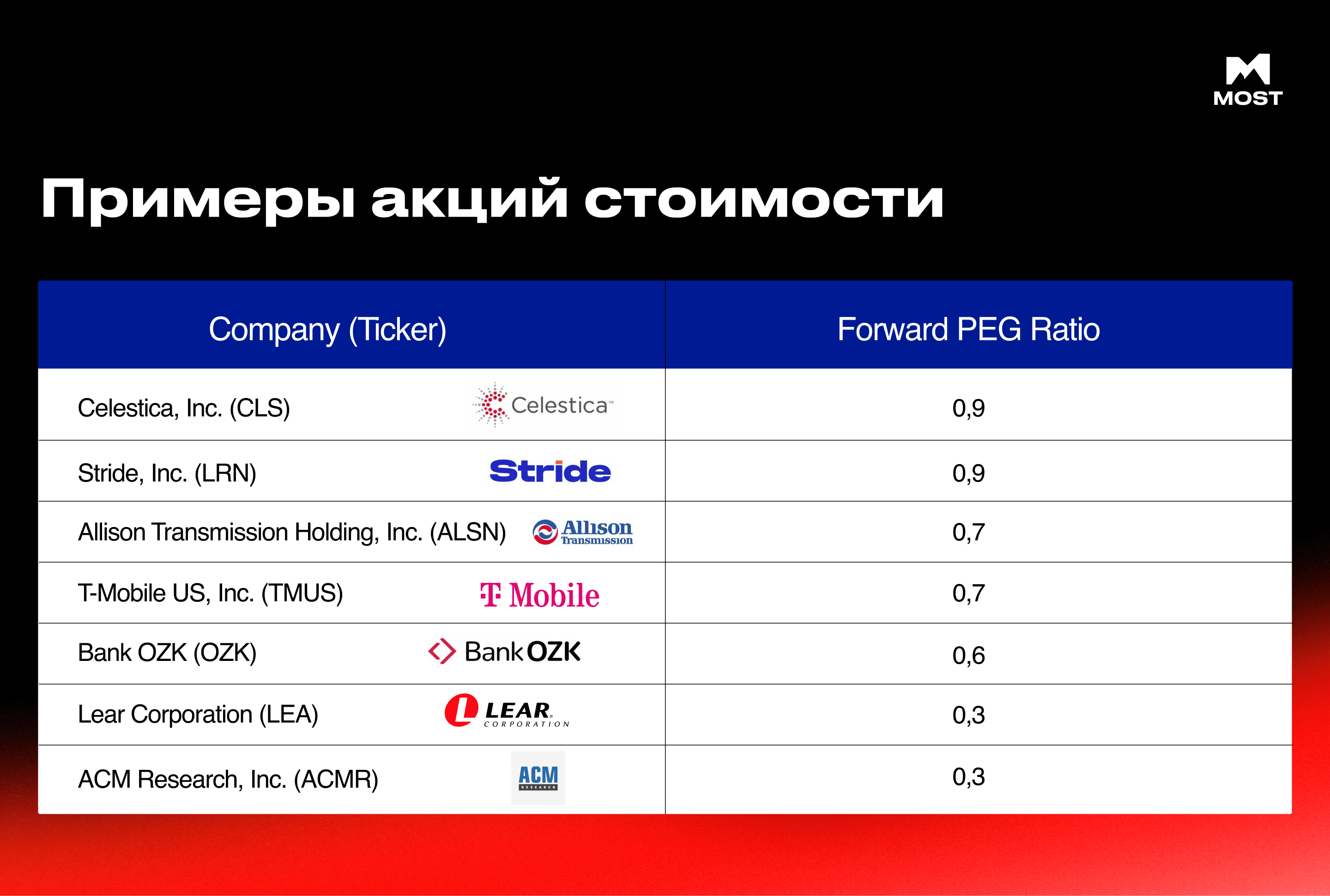

Value Stock Examples

Источник: Forbes

MOST Ventures is a venture capital fund that provides unique opportunities for investors focused on IT startups in Central Asia. We support startups at the Pre-Seed, Seed and Series A stages, providing high growth and profitability prospects. Join us and invest in the future of technology. Details on the website.

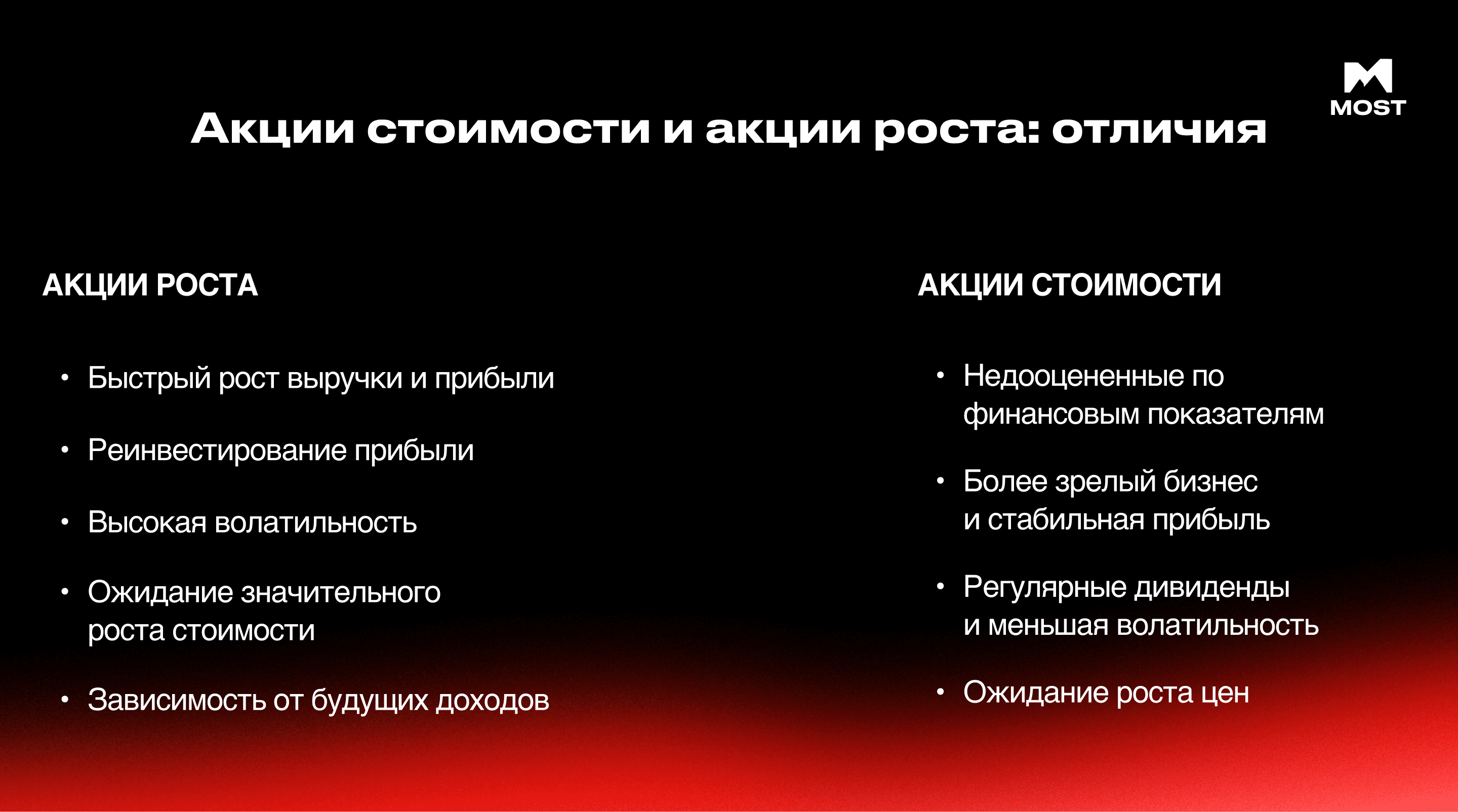

Value Stocks and Growth Stocks: Differences

Growth Stocks:

Rapid Revenue and Earnings Growth:

Growth companies typically experience significant revenue and earnings growth. Their business models are often innovative and focused on expanding market share and scaling operations quickly.

Profit Reinvestment:

The funds generated by growth companies are typically funneled back into the business to support further expansion, research and development, and market penetration, rather than distributed as dividends.

High Volatility:

Growth stocks tend to be more volatile due to high investor expectations and fluctuating valuations. Their prices can be sensitive to market sentiment, economic conditions, and company performance.

Expectation of Significant Growth:

Investors buy growth stocks with the expectation that the company will continue to grow rapidly, leading to significant share price increases over time.

Dependent on Future Earnings:

The valuation of growth stocks is heavily dependent on expected future earnings. Any deviation from the projected growth rate can lead to sharp price fluctuations.

Value Stocks:

Undervalued by Financials

Value stocks are often identified by financial metrics that indicate they are trading at a lower price than their intrinsic value. Common metrics include:

A lower P/E ratio than the market average suggests that the stock is undervalued relative to its earnings.

A higher than average dividend yield may be a sign that the stock is undervalued, as the market price may not fully reflect the company's dividend-paying potential.

More mature businesses and stable earnings

Value stocks are typically owned by companies with a long-standing reputation. They operate in mature sectors with stable demand. These companies often have large market shares, which provides them with financial stability.

Regular dividends and lower volatility

One of the appealing aspects of value stocks is their tendency to pay dividends regularly, which can provide investors with a stable income. Mature companies with stable earnings are more likely to return profits to shareholders in the form of dividends. Value stocks typically exhibit less price volatility, making them attractive to risk-averse investors.

Expectation of Price Growth

Investors buy value stocks with the expectation that their fair value will be recognized by the market. Over time, this recognition should lead to higher prices. Profiting from value stocks often requires a long-term investment horizon and patience, as the market may take time to adjust.

Value vs. Growth Stocks

There is no one-size-fits-all answer to whether to invest in value stocks or growth stocks. Choosing the best approach depends on a careful assessment of your financial goals, risk tolerance, investment horizon, and current market conditions. Understanding the differences and advantages of value and growth stocks can help you make informed decisions that align with your investment strategy and help you achieve your financial goals.

Whether you choose the stable, income-producing path of value investing or the dynamic path of growth stock investing, a well-thought-out strategy will be the key to your long-term investment success.